Investing in rental property abroad allows you to potentially achieve a higher rental yield than in the UK. However, this type of investment, far from your primary residence, comes with its own unique considerations.

Why invest in property abroad?

Every property owner can have different motivations: building wealth, receiving additional income during retirement, reducing tax pressure, passing on a property, etc. Your personal asset strategy might lead you to favor certain destinations over others. The requirements will not be the same for a rental investment in Italy versus one in Portugal (differences in price per square meter, administrative formalities, tax treatment, etc.).

Overall, purchasing a rental property abroad offers you several advantages:

- This acquisition firstly results in the diversification of your assets. The approach is wise if you have already heavily invested in the English property market. By acquiring interests in another country, you ensure better risk distribution.

- You benefit from a better rental yield. This difference is due to a simple factor: purchase prices are generally higher in major English cities for an equivalent rent level.

- You can also take advantage of the dynamic property market in a particular region and the rapid increase in selling prices. By positioning yourself at the right time, it is possible not only to achieve significant rental margins but also to generate substantial capital gains on resale. For instance, property prices have increased by 4.65% in Italy between 2023 and 2024 Buyers who purchased last year have already realized a significant capital gain.

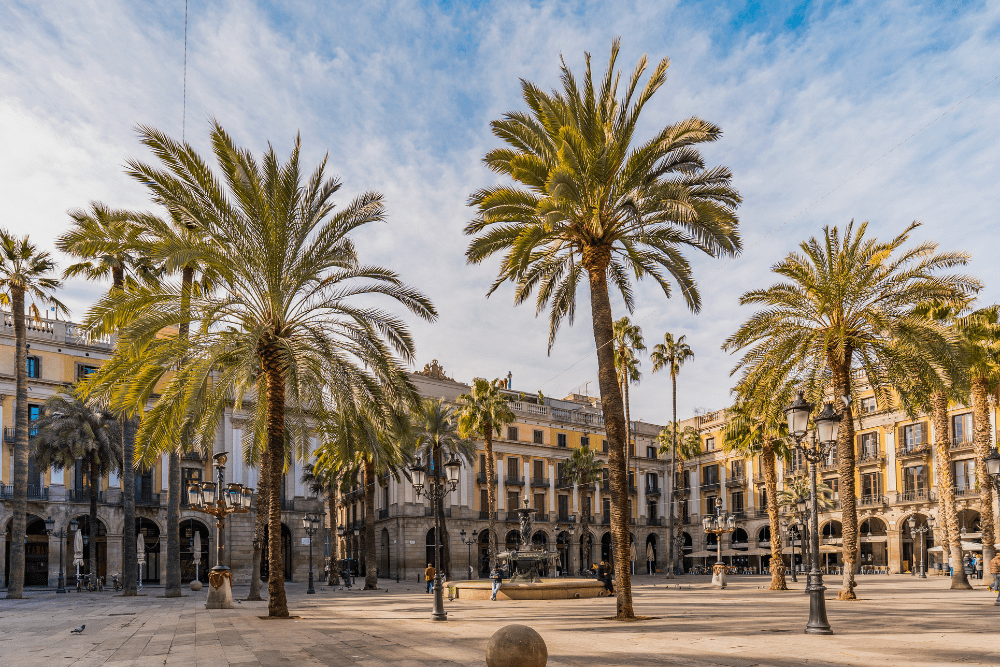

Rental property prices abroad are often more accessible than in the UK. For example, the price per square metre for an apartment in the city centre is £3,087.77 in Spain against £5,003.90 per square metre in the UK.

Financing a rental property investment abroad

A rental property investment generally involves taking out a mortgage. Two solutions are available to an English buyer wishing to become a property owner abroad:

- Obtaining a mortgage in the UK:

Many English banks can support your property purchase and rental investment project, even if the property is located in a neighboring country (Spain, Portugal, Italy, Greece…). However, this represents an additional risk for the lender. Therefore, expect to justify solid guarantees: a mortgage at least equal to the loan amount, borrower insurance, and a personal contribution covering at least the acquisition costs. - Securing a mortgage locally:

In this case, the conditions can vary greatly from one country to another. For instance, a loan for a rental property investment in Portugal can cover up to 70% of the property’s value if the buyer is not a tax resident in the country, or 80% if they are. It is possible to borrow for a maximum term of 40 years, provided the last installment is paid before a certain age (usually 70 years).

Carefully research the borrowing conditions in the concerned country, as well as the various non-negotiable fees (taxes, registration fees, notary or agency fees, etc.).

You can also consider other options to finance your property abroad, such as paying in cash thanks to the sale of your property in the UK. To know more about your options, consult our dedicated article: How to finance a property abroad?

Do not rush, even if the opportunity seems too good to miss and creates a sense of urgency. For your first rental property investment abroad, as well as for subsequent ones, it is essential to visit the property in person. This will allow you to objectively assess the strengths and weaknesses of your future rental property.

Moreover, our iad Overseas property consultants can arrange visits, either virtually or in person.

How to rent out a property abroad?

Investing in rental property in another country means dealing with a completely different legislative, regulatory, and fiscal environment compared to the UK. Be sure to consider the following:

- The amount of fees and taxes to be paid for the transaction;

- The applicable taxation on rental income in the country and the existence of any tax treaty with

- the UK on this matter;

- The cost and guarantees to be provided for rental property insurance;

- The estimated amount of co-ownership charges…

A rental property project abroad should not be undertaken lightly! The assistance of a local property consultant, familiar with all the market subtleties, will be essential for:

- Selecting the property that best fits your criteria;

- Helping you navigate the various administrative procedures;

Companies in property management, for example, will be able to:

- Monitor the monthly rent payment by the tenant;

- Oversee renovation or repair works;

- Conduct property visits when renting out the property;

- Conduct the check-in and check-out inspections…

Consider looking abroad for a profitable rental investment! Some Southern European countries, such as Italy, Spain, or Portugal, have a very dynamic property market where opportunities abound. Do not hesitate to get in touch with an iad Overseas property consultant to learn about the current opportunities.

- A well-prepared rental investment abroad can be particularly profitable.

- Determine the ideal financing solution for you and the amount you need as soon as possible.

- Seek assistance from a local property professional for a smooth and successful investment.