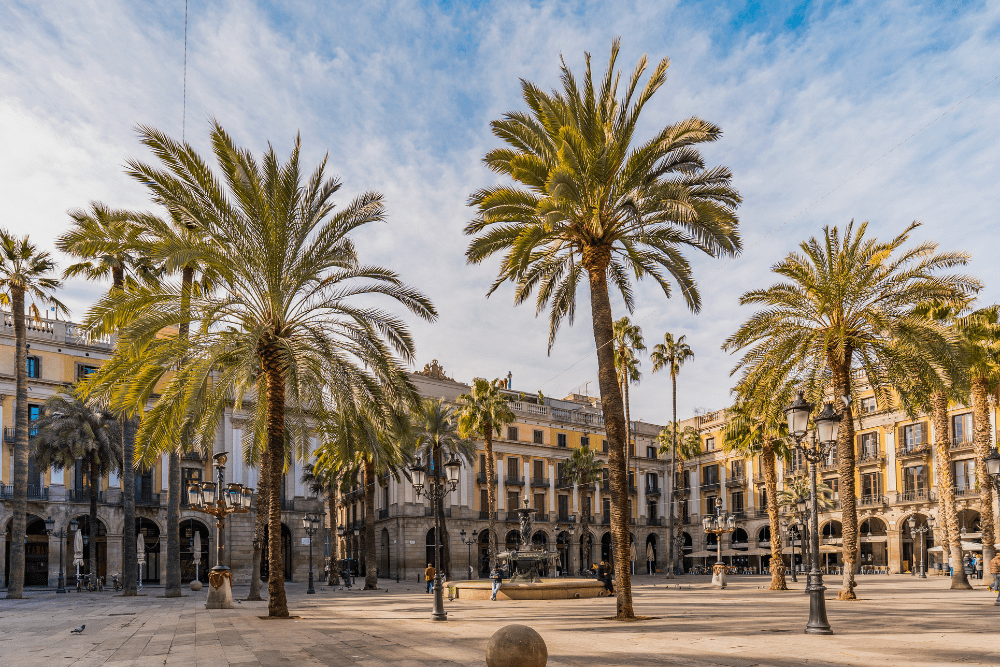

Thinking about investing in Alicante to enjoy the charm of the Costa Blanca in a second home? Looking for a rental property in Italy or on the Algarve coast? Investing in property abroad, from the UK, is a very specific process that requires careful consideration. Here are the key points to remember.

Investing abroad: advantages and disadvantages

The advantages of investing in property abroad should not be overlooked. The buyer benefits from:

Diversifying their personal assets with a property located outside the UK;

- A holiday home in typically milder climates;

- Cultural enrichment through interaction with the local population;

- A cost of living much lower than English standards

The main disadvantages include:

- The distance from the UK, leading to a cultural change that requires some adjustment time;

- Remote rental management, which is more challenging for a landlord;

- Specific administrative procedures of the chosen country, which can be time-consuming depending on the destination.

Understanding the legal framework of property investment

Investing in property abroad involves following a procedure that is necessarily different from that in the UK. Points to consider may include:

- The role of the solicitor (or equivalent) in completing the transaction – ranging from simple official registration to providing a genuine guarantee of its authenticity, as in the UK;

- The amount of fees and taxes to be paid to complete the transaction;

- The maximum amount that can be borrowed through a mortgage;

- The cost and guarantees required for home insurance;

- The amount and payment method for condominium fees.

Want to invest in Spain? The various taxes applicable to a property purchase can reach up to 13% of the sale price. It is therefore important to anticipate these costs when planning your property investment in Spain. An iad Overseas consultant will be able to guide you and provide you with the right information.

Comparable taxation to a property rented in the UK

Investing in foreign rental property does not typically provide any special tax advantages. The owner remains subject to UK income tax on all rental income if they maintain their status as a tax resident of the UK. As a reminder, tax residency is established if any one of the following three conditions is met:

- Spending more than six months (183 days) in the UK during the tax year;

- Having a home in the UK at least 91 days during the year (including 30 days during the tax year);

- Working full-time in the UK (365 days).

The different options for investing in property abroad

The first option is, of course, to acquire a physical property located in another country. This might involve, for example, buying inexpensive land abroad to either build on it or realise a capital gain upon resale. You then own the property outright and can freely occupy or rent it.

However, direct purchase of property is not the only way to invest abroad. To benefit from the dynamism of international real estate, you can also consider, for example, real estate investment trusts (REIT), which are publicly traded companies investing in various types of property (hotels, hospitals, residential properties, etc.).

What is the best country for property investment?

There is no definitive answer to this question. It largely depends on your personal goals and preferences for each destination. Whether you are considering purchasing property in Italy, Portugal, Spain, or Greece, do not overlook the value of local expertise! An iad Overseas property consultant can assist you at every step, up to the signing of the sales contract.

- Buying property abroad is an excellent way to diversify your assets.

- The process requires careful preparation and a good understanding of the local property market.

- Seeking the help of an international property investment consultant is recommended for your peace of mind.